Contrast to Sign up for Medicare Advantage Plans: Trim Hundreds of dollars on Insurance and Get Started

Understanding Medicare Advantage Plans

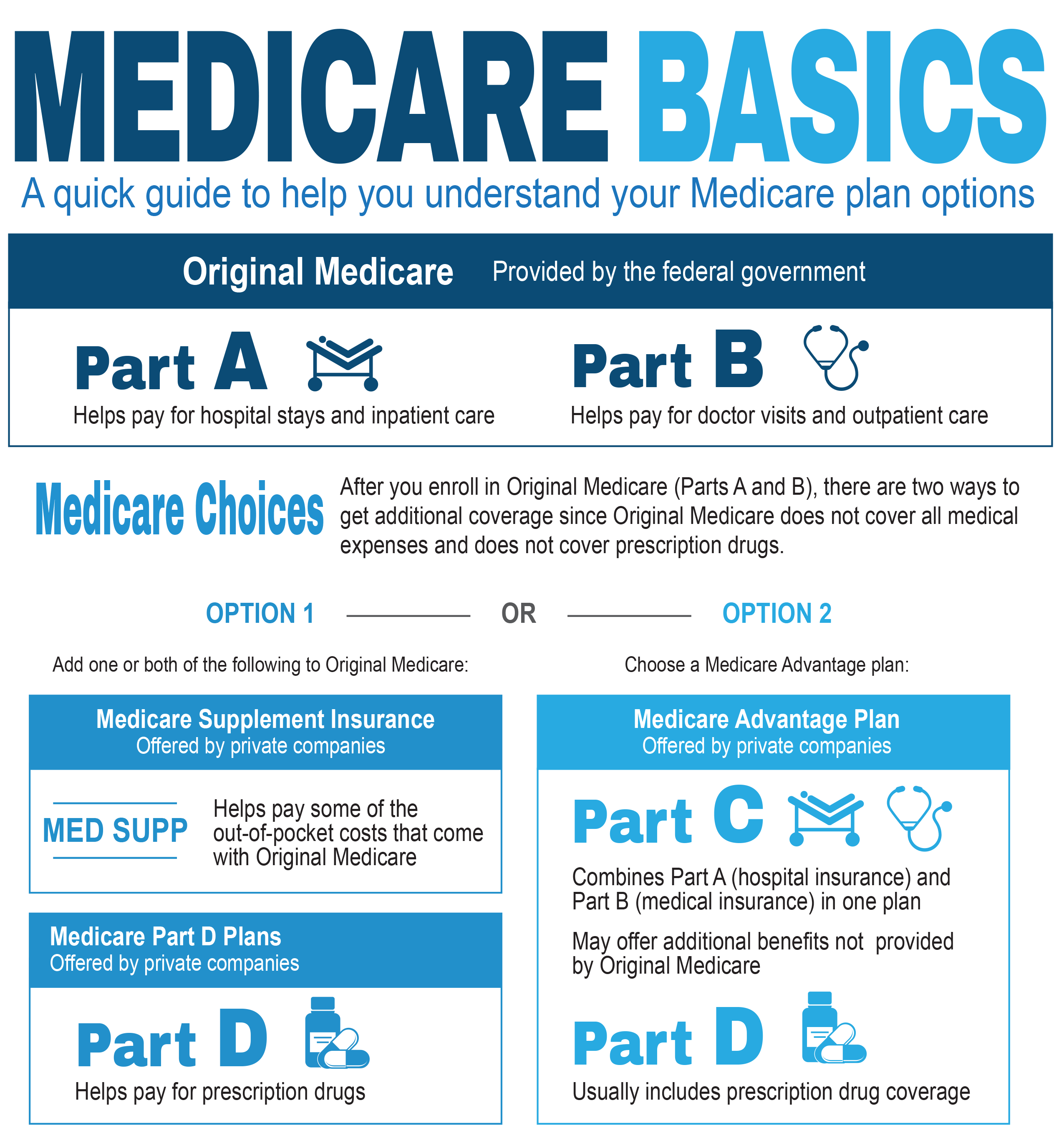

Medicare Advantage Plans represent provided by private Insurance carriers that partner with Medicare to offer Part A as well as Part B coverage in PolicyNational Medicare Advantage Plan a single coordinated format. In contrast to traditional Medicare, Medicare Advantage Plans commonly feature supplemental benefits such as prescription coverage, dental care, vision services, and health support programs. These Medicare Advantage Plans function within specific coverage regions, making location a critical factor during evaluation.

How Medicare Advantage Plans Vary From Original Medicare

Traditional Medicare offers broad doctor availability, while Medicare Advantage Plans generally use managed care networks like HMOs even PPOs. Medicare Advantage Plans may include provider referrals and/or in-network providers, but they frequently offset those restrictions with consistent out-of-pocket amounts. For many enrollees, Medicare Advantage Plans offer a blend between affordability and added services that Traditional Medicare alone does not typically deliver.

Who Should Look into Medicare Advantage Plans

Medicare Advantage Plans attract individuals interested in organized healthcare delivery not to mention expected financial savings under a single plan structure. Beneficiaries handling ongoing conditions often choose Medicare Advantage Plans because integrated care models simplify treatment. Medicare Advantage Plans can additionally attract enrollees who want bundled services without handling several secondary coverages.

Eligibility Guidelines for Medicare Advantage Plans

To qualify for Medicare Advantage Plans, enrollment in Medicare Part A together with Part B must be completed. Medicare Advantage Plans are available to the majority of people aged 65 in addition to older, as well as under-sixty-five individuals with eligible disabilities. Participation in Medicare Advantage Plans is based on residence within a plan’s coverage region not to mention enrollment timing that matches authorized sign-up windows.

Best times to Enroll in Medicare Advantage Plans

Proper timing holds a vital function when enrolling in Medicare Advantage Plans. The Initial sign-up window centers around your Medicare eligibility date also permits first-time selection of Medicare Advantage Plans. Missing this timeframe does not automatically end eligibility, but it does limit available options for Medicare Advantage Plans later in the year.

Yearly and also Qualifying Enrollment Periods

Every fall, the Yearly Enrollment Period allows individuals to change, drop, in addition to enroll in Medicare Advantage Plans. Special Enrollment Periods become available when qualifying events happen, such as moving along with loss of coverage, allowing changes to Medicare Advantage Plans outside the typical timeline. Recognizing these periods helps ensure Medicare Advantage Plans remain available when situations evolve.

How to Review Medicare Advantage Plans Successfully

Evaluating Medicare Advantage Plans involves care to beyond recurring premiums alone. Medicare Advantage Plans change by provider networks, out-of-pocket maximums, prescription formularies, also coverage rules. A detailed analysis of Medicare Advantage Plans assists matching healthcare priorities with coverage structures.

Costs, Benefits, as well as Network Networks

Monthly expenses, copays, & yearly limits all influence the overall value of Medicare Advantage Plans. Certain Medicare Advantage Plans include reduced premiums but increased out-of-pocket expenses, while alternative options prioritize consistent spending. Doctor availability also changes, so making it necessary to verify that preferred doctors work with the Medicare Advantage Plans under review.

Prescription Benefits as well as Additional Benefits

Many Medicare Advantage Plans include Part D drug coverage, simplifying prescription handling. Outside of medications, Medicare Advantage Plans may offer fitness programs, ride services, plus OTC benefits. Assessing these extras supports Medicare Advantage Plans fit with daily medical requirements.

Signing up for Medicare Advantage Plans

Enrollment in Medicare Advantage Plans can take place digitally, by phone, as well as through licensed Insurance Agents. Medicare Advantage Plans require accurate personal details together with verification of eligibility before activation. Completing registration accurately prevents delays and/or unexpected coverage gaps within Medicare Advantage Plans.

Understanding the Role of Licensed Insurance Agents

Licensed Insurance Agents help clarify coverage details in addition to explain distinctions among Medicare Advantage Plans. Consulting an expert can address network restrictions, coverage boundaries, & costs linked to Medicare Advantage Plans. Professional assistance often streamlines decision-making during enrollment.

Common Missteps to Watch for With Medicare Advantage Plans

Overlooking provider networks remains among the frequent errors when selecting Medicare Advantage Plans. Another problem centers on concentrating only on monthly costs without reviewing annual spending across Medicare Advantage Plans. Reading plan documents carefully prevents confusion after sign-up.

Reassessing Medicare Advantage Plans Each Year

Medical needs change, and Medicare Advantage Plans change every year as part of that process. Reviewing Medicare Advantage Plans during annual enrollment periods allows updates when benefits, costs, or providers shift. Regular evaluation keeps Medicare Advantage Plans matched with current healthcare goals.

Why Medicare Advantage Plans Keep to Increase

Participation patterns show growing demand in Medicare Advantage Plans nationwide. Expanded coverage options, predictable spending limits, in addition to managed healthcare delivery help explain the growth of Medicare Advantage Plans. As options multiply, well-researched comparison becomes even more valuable.

Long-Term Benefits of Medicare Advantage Plans

For numerous beneficiaries, Medicare Advantage Plans deliver reliability through integrated coverage and structured care. Medicare Advantage Plans can lower administrative burden while supporting preventative care. Identifying well-matched Medicare Advantage Plans creates confidence throughout retirement stages.

Evaluate as well as Choose Medicare Advantage Plans Now

Making the next move with Medicare Advantage Plans begins by examining available options not to mention checking eligibility. Whether you are new to Medicare and/or reassessing existing benefits, Medicare Advantage Plans offer versatile coverage options created to support diverse medical needs. Explore Medicare Advantage Plans today to find a plan that aligns with both your health together with your financial goals.